Free Shipping On world wide

- HOME

- PRODUCTS

- IN THE NEWS

- SPECTRUM BLOG

- WEB SPECTRUM VIEWER

-

English

-

USD

Free Shipping On world wide

In late November, Mike Dano highlighted that T-Mobile had cancelled over 500 millimeter wave licenses where they didn't want to meet the buildout obligations. Upon investigating the cancelled licenses further, we found that all of the cancelled licenses were 28 GHz licenses. It would seem that the 28 GHz licenses would be more difficult to meet the covered population criteria for substantial service since each of the licenses are for individual counties. The other millimeter wave licenses are PEA market licenses, providing at least one population dense county where a significant portion of the PEA population can be served.

To see the collective effect of these license cancelations we are going to look at the 28 GHz licenses that were in FCC control before T-Mobile cancelled their slew of licenses. Our database management process for the Web Spectrum Viewer and Spectrum Ownership Analysis Tool allow us to assign cancelled licenses to the FCC. The FCC ULS system doesn't allow unissued license areas to be queried, and cancelled licenses are also difficult to identify.

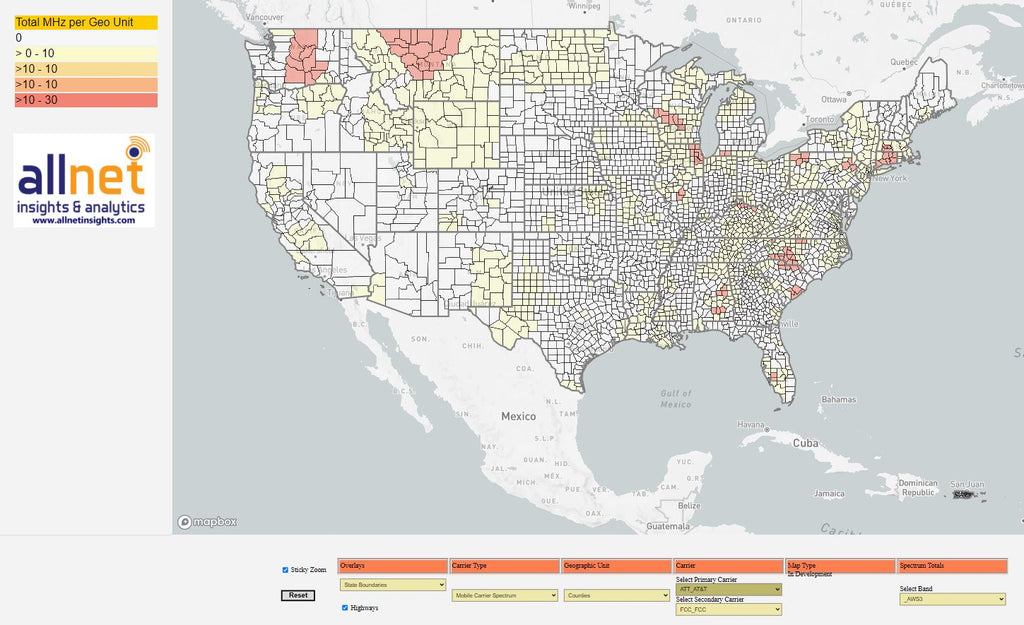

In the map below, the 28 GHz licenses in FCC control are displayed. Most of the license areas are low population counties that didn't receive bids in the 28 GHz auction.

On August 16th, AT&T filed a petition to deny SpaceX's waiver request that would allow SpaceX to operate from space on T-Mobile's PCS G channels. From the Web Spectrum Viewer map below, it is evident that T-Mobile controls nationwide access to the PCS G channel except for some places in Wyoming, Nebraska, Kansas, and Oklahoma where they are leasing those channels to regional carriers.

Spectrum Depth Map - T-Mobile (PCS-G):

| Carrier | Counties Owned | % of Counties | Population Sum | % of Population |

| T-Mobile | 1399 | 40.1%` | 184,121,282 | 54.6% |

| AT&T | 915 | 28.3% | 66,836,869 | 19.8% |

| Verizon | 631 | 19.5% | 72,904,442 | 21.6% |

| USCellular | 134 | 4.1% | 6,613,176 | 2.0% |

| Viaero | 84 | 2.6% | 1,172,483 | 0.3% |

| C Spire | 32 | 1.0% | 1,087,192 | 0.3% |

When the EBS Auction was held, auction participants had to negotiate a maze of licensing contours to determine the license area that they would receive with a successful bid.

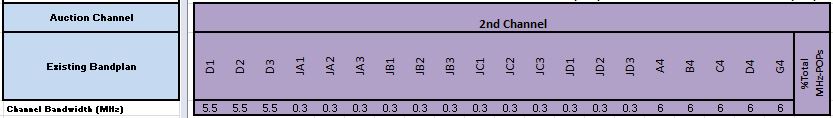

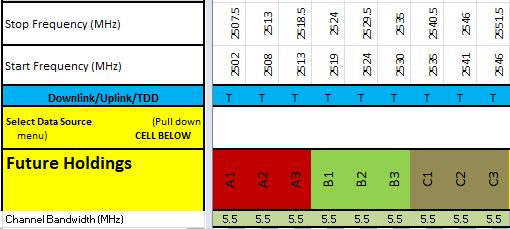

This complexity increased when the FCC combined multiple channels (which likely have different contours) to form the wide band auction channels. As a reminder, the subchannels of the C1 auction channel are pictured below.

.

To determine the license areas for your white space channel deployment, you can use the Web Spectrum Viewer to see our understanding of each white space area. Our white spaces areas have already remove the established 35 mile radius licenses and the Tribal licenses areas that were granted before the white space areas were created.

In the EBS Auction module, the license county is selected first in the EBSBRS Pops menu. This view displays the population available in the white space area for each C1 auction channel. Looking at the output for Bibb County, Alabama; we can see that 12, 173 people are in the license area for all of the A channels, and B channels. The C channels don't have any people in the white space area so the auction winner cannot put towers or allow RF signals to propagate on the C channels in this county.

Clicking on the EBSA1 population cell reveals a white space license area map for the A1 channel. The yellow white space contour can be saved either as a jpeg map or as a kml file for Google Earth.

T-Mobile made commitments to the FCC in the Memorandum Opinion and Order in their application for their Auction 108 (2.5 GHz Band Licenses). T-Mobile committed to divest by sale or swap, 20 MHz of spectrum in the AWS-1, AWS3, PCS, or 2.5GHz bands. The spectrum sold will be no smaller than 10 MHz blocks of TDD spectrum or 5x5 MHz blocks of FDD (paired) spectrum. T-Mobile has twelve months to file the transfer applications.

The FCC specifically called out two CMA markets where T-Mobile will need to divest spectrum: CMA385 - Kauai and CMA386 - Maui. Although T-Mobile's held spectrum in Hawaii doesn't stand out compared to other markets in the US, the issue with the spectrum screen in Hawaii is that 3.45 GHz spectrum (100 MHz) and C-band spectrum (280 MHz) are not available. This reduces the available spectrum by almost 400 MHz, thus reducing the spectrum screen by potentially 126 MHz.

In the above map, the CMA markets in Hawaii are indicated. To see how each carriers spectrum totals up in each of these markets we will utilize our Web Spectrum Viewer - Spectrum Depth Module. First we have exported the county spectrum totals by band classification. Kalawao and Maui county make up CMA 386 and Kauai county makes up CMA385. The bottom 3 counties in the chart below represent the counties where T-Mobile needs to divest 20 MHz of spectrum.

Reviewing the data, it is clear that T-Mobile's lower mid-band spectrum and upper mid-band spectrum are the two areas where T-Mobile has a sizable advantage. I assume that EBS/BRS spectrum is off the table from T-Mobile's perspective and it would be difficult to sell that band due to T-Mobile's nationwide "exclusive" use.

Looking then at the lower mid-band spectrum, T-Mobile's held spectrum in both the AWS-1 and AWS-3 bands is pretty similar with Verizon and AT&T.

I will also note that if T-Mobile was to give up any of their AWS-1/AWS-3 spectrum holdings they would drop below their desired 20MHz channel in NR band 66.

There are two considerations for T-Mobile's PCS spectrum. First, T-Mobile controls two blocks of spectrum in all of the Hawaii counties, 15 MHz at the bottom of the band and 20 MHz at the top. I believe that T-Mobile's agreement with SpaceX utilizes the PCS G channels at the top of the PCS band, so I think the upper block will be retained. In a perfect world, T-Mobile would sell a 10x10 slice (A8-A11) of their lower block of spectrum to Verizon and swap their A6-A7 spectrum with Verizon for Verizon's F1-F2 spectrum. In this scenario, Verizon would increase their channel size in two of these counties from 10/10 to 20/20 and in Kauai they would have 25/25. T-Mobile would then have all of their spectrum together and could have a NR band 25 - 20MHz channel and a dedicated 5 MHz channel for SpaceX.

Add your thoughts to our LinkedIn post or the post on X.

(DA No. 24-183). Public Notice announcing that certain Auction 108 licenses are granted.

On July 11, 2019, the FCC released a report and order that provided a pathway to commercial ownership of the 2.5GHz Educational Broadcast Service (EBS) channels that were previously reserved for educational groups. In this post, I am going to examine the progress that T-Mobile has made in shifting from leasing this spectrum to owning it.

We will be looking at two trends, using historical data from Spektrum Metric's Mobile Carrier - Spectrum Ownership Analysis Tool. The Mobile Carrier - Spectrum Ownership Analysis Tool is updated monthly and provides historical analysis going back to 2014.

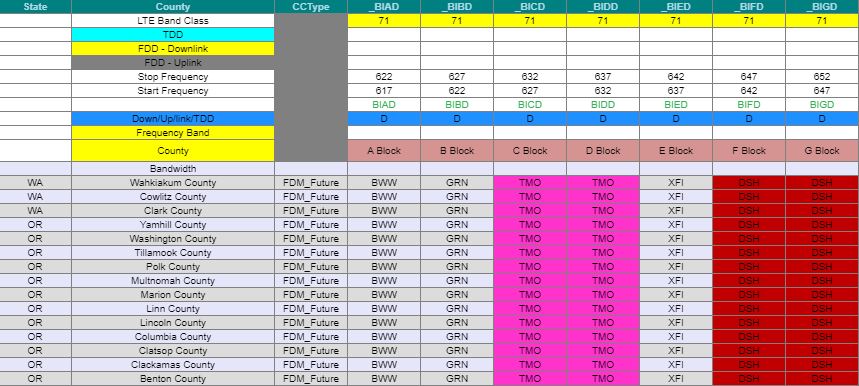

Looking at our Spectrum Ownership Grid in the Web Spectrum Viewer, T-Mobile's control of the EBS spectrum is clearly seen. This is our Spectrum Grid displaying "Future" data which includes spectrum that T-Mobile leases or has a pending transaction filed.

Spectrum Grid - Future:

Shifting to the Spectrum Ownership Grid to display the spectrum licensee "FCC" reveals the licenses that T-Mobile actually owns. All of the white cells are educational licenses that likely lease their spectrum to T-Mobile.

Spectrum Grid - FCC:

National Weighted Spectrum Depth Trend:

The spectrum available in the EBS and BRS (Broadband Radio Service) bands for each county totals 194 MHz. If T-Mobile controlled every license in every county their National Population Weighted Average spectrum depth in the 2.5 GHz band would be 194 MHz, thus any amount of below 194 MHz represents another licensees ownership or lease of spectrum in these bands.

After the EBS Auction was completed, T-Mobile's total 2.5 GHz spectrum (orange line) rose from roughly 164 MHz to 180 MHz, indicating that about 14 MHz of Nationally Weighted Spectrum is controlled by other carriers and licensees. The spike in September 2022 indicates the release of the auction results.

Over the same time period we quantified the spectrum that was directly owned by T-mobile (blue line). Note: The EBS Auction results are not reflected in this trend line because T-Mobile has not received direct ownership of the licenses. In the December 2010 to June 2023 timeframe, T-Mobile increased their ownership of the EBS spectrum by 11 MHz (National Weighted Population Spectrum Depth).

Previously we have written about the CBRS Consent Decree between the FCC and SAL Spectrum, Cable One, NorthWestern Corporation, US Cellular Corporation, and Shenandoah Cable Television. Each of these CBRS auction winners had an investment from Black Rock, Inc greater than 10% interest. Below are charts that reflecting each carrier's auction winnings, the licenses that they requested following the consent decree, and changes to each carriers market assignments.

Looking at the Combined Blackrock from the Auction Results table, there are many markets where the combined group has auction spectrum allotments of 60MHz. In the Updated License table, many markets went from being above the 40MHz limit to being below the 40MHz limit. This is primarily due to SAL Spectrum (ATNI) declining any spectrum assignments in virtually all of these markets.

The last column to highlight is the GAA Increase column in the Change table. This column reflects the net increase in GAA available spectrum in each market since the FCC is not planning to reauction this spectrum since it can still be utilized through the GAA usage process.

Arkansas and Illinois:

Missouri:

Maryland, Montana, Virginia, Washington, and Wisconsin:

On Friday, the FCC posted the results from Auction 110. On Saturday we updated the January 2021 release of our Mobile Carrier - Spectrum Ownership Analysis Tool to reflect the auction results. These results provide the most detailed view of each carrier's spectrum that can be deployed for 5G, particularly all of the available upper mid-band spectrum including EBS/BRS, 3.45GHz, CBRS, and C-band.

In the Spectrum Grid, we can see the channel allocations. In general, Dish took the upper end of the band with T-Mobile and AT&T alternate having the lower parts of the band. In many markets, AT&T is pinned in the middle of the band between T-Mobile, Grain, and Columbia Capital. Each of the spectrum investors has selected spectrum assignments adjacent to AT&T's spectrum meaning they are each well positioned to sell to AT&T if the 3.45GHz spectrum cap is lifted.

In the National Band Ownership slides we look at each carrier's ownership based upon the percent of MHz-POPs that they control.

For the 3.45GHz band, AT&T leads the way with 39% of the MHz-POPs, Dish has 30%, T-Mobile has 12%, and USCellular has 4%.

Looking the the complete picture for Upper Mid-band spectrum, T-Mobile still leads with 34%, Verizon follows with 30%, then AT&T with 24%. Dish has 9% of the upper mid-band MHz-POPs and USCellular has 2%.

In our December month-end review of open FCC transactions, we saw significant progress from the FCC in the processing the EBS tribal applications. 56 of the pending transactions were granted, reducing the remaining pending applications to 40.

FCC Tribal Application Status

|

Status

|

5/5/2021

|

10/31/2021

|

12/31/2021

|

|

Granted

|

201

|

273

|

329

|

|

Pending

|

175

|

94

|

40

|

|

Inactive/Withdrawn

|

7

|

5

|

|

|

Dismissed

|

18

|

20

|

20

|

|

Total

|

394

|

394

|

394

|

In our most recent blog post, we highlighted the challenges faced by T-Mobile in two markets where they don't control parts of the EBS spectrum (channels), that limit their deployment of large 5G channels across each urban market. Where that post focused on the effects of owning or not owning a specific channel across a geography, the EBS Spectrum Control Maps below provide a more general look at the percent of EBS spectrum that T-Mobile owns, the FCC owns, and Other Carriers own. To complete this analysis we used the MHz-POPs analysis from our EBS Auction Tool, combined with our analysis of T-Mobile's EBS MHz-POPs using the same geographic licensing database.

While these maps provide insights on the EBS band in totality, the individual issues faced by T-Mobile in Orange County, CA don't strongly appear in these maps because they control all of the EBS channels except the G channels meaning they still control a high percentage of the EBS spectrum in Orange County. For the Chicago market, the whitespace EBS challenges can be seen with Lake County receiving a light green and McHenry receiving an orange.

Today was the cutoff for comments on the EBS Whitespace Auction procedures, so let's take a look at the current status of the EBS Tribal applications, which have a priority on claiming EBS white space. From the chart below, 44% of the applications are still in process. Most concerning are the 83 applications that have been filed but have not seen any action by the FCC. Typically applications are moved to a pending status within a few weeks but these applications have been on file since 3Q - 2020.

| Tribal Applications | Status |

| Filed | 394 |

| Granted | 201 |

| Pending | 92 |

| Dismissed | 18 |

| No Action | 83 |

Below is a map of the granted tribal boundaries overlaid with the EBS A1 channel license areas. Each of these tribal applications has requested access to the first EBS auction channel (49.5MHz). Any tribal areas that extend into these license areas will not have access to the A1 channel (5.5MHz) in the overlap area.

Last year we provided an FCC Spectrum Screen Analysis reflecting the effects of the EBS reconfiguration, the CBRS allocation, and the C-band allocation. Two weeks ago the FCC has revised the Sub-6 GHz spectrum screen through their 3.45GHz rulemaking.

In the chart below we reflect the spectrum depth allotments that are included in our Mobile Carrier - Spectrum Ownership Analysis Tool. The links under in the frequency column will open the FCC spectrum screen documents and the comment field indicates the paragraphs where the spectrum screen is discussed.

The Allnet Spectrum Depth column indicates the spectrum allocations that we use in all of our typical spectrum depth reporting (county, CMA, PEA, State, and National). The FCC / Allnet Spectrum Screen allocations reflect the allocations that we use in our County, CMA market, and PEA Market Spectrum Screen columns.

| Band | Frequency | Allnet Spectrum Depth | FCC / Allnet Spectrum Screen | Comments |

| Low Band | 600 MHz | 70 | 70 | |

| Low Band | 700 MHz | 90 | 70 | First Net Spectrum not included |

| Low Band | Cellular | 50 | 50 | |

| Low Band | SMR | 14 | 14 | |

| Lw Mid Band | PCS | 140 | 140 | Includes H-block |

| Lw Mid Band | AWS-1 | 90 | 90 | |

| Lw Mid Band | AWS-3 | 65 | 65 | |

| Lw Mid Band | AWS-4 | 40 | 40 | |

| Up Mid Band | WCS | 30 | 20 | |

| Up Mid Band | BRS | 77.5 | 67.5 | BRS1 and BRS K guard bands not included |

| Up Mid Band | EBS | 116.5 | 116.5 | Paragraph 98-100 |

| Up Mid Band | 3.45GHz | 100 | 100 | Paragraph 101 |

| Up Mid Band | CBRS | 0 | 0 | Paragraph 107 |

| Up Mid Band | C-Band | 280 | 280 | Paragraph 83 |

| Total MHz | 1163 | 1123 |

To determine the overall Spectrum Screen value, the FCC divides the spectrum screen allotment (1123) by 3 and rounds to the nearest 10MHz. This makes the new spectrum screen including the 100MHz of 3.45GHz spectrum, 370 MHz.

In the Mobile Carrier - Spectrum Ownership Analysis Tool we have three views into the Spectrum Screen. They are a County Analysis View, a Cellular Market Area (CMA) View, and a Partial Economic Area (PEA) View.

County Analysis View:

In this view, each of the national carriers spectrum screen values are displayed along with the amount of spectrum in that county controlled by the FCC. The FCC value predominately represents the 3.45GHz spectrum allocation, but there is some EBS spectrum (whitespace) that is also allocated to the FCC.

PEA Market Analysis View:

The FCC announced the final rules for the new 3.45GHz band on March 19, 2021. With our April 2021 release, we updated our Mobile Carrier - Spectrum Ownership Analysis Tool to include the 3.45GHz frequency band in each of the analysis modules. The 10 - 10MHz channels appear in our Spectrum Grid as a part of NR Band 77. In the image below, we highlight the FCC's ownership of each of the channels (pre-auction) by county.

Honolulu County has a NA (Not Available) code for both the 3.45GHz spectrum and the C-band spectrum since neither band in available in Hawaii, Alaska, Puerto Rico, American Samoa, Northern Mariana Islands, Virgin Islands, and Puerto Rico. Looking at the National Band Ownership Charts, we can see that this unavailability affects 2% of the MHz-POPs or 2% of the US Population (~6.6M).

In the County Analysis Module the spectrum depth values for eight selected carriers are displayed. This image highlights each carriers 3.45GHz, CBRS, and C-band holdings.

Below is a more detailed description of our Spectrum Ownership Analysis Tools and the analysis capabilities it supports.

| Attachment A | |||||||||||

| Auction 108 License Inventory Subject to the Results of the Rural Tribal Priority Window | |||||||||||

| Proposed Bidding Units, Upfront Payments, and Minimum Bids | |||||||||||

| State/ Territory |

County Name | FIPS Code |

Channel | Item ID | Band- width |

MEA | Population (2010) |

Subject to Small Market Cap | Bidding Units |

Upfront Payment |

Minimum Bid |

| AL | Autauga | 1001 | 1 | AL-001-1 | 49.5 | 24 | 54,571 | Yes | 80 | $8,000 | $10,000 |

| AL | Autauga | 1001 | 2 | AL-001-2 | 50.5 | 24 | 54,571 | Yes | 80 | $8,000 | $10,000 |

| AL | Autauga | 1001 | 3 | AL-001-3 | 16.5 | 24 | 54,571 | Yes | 20 | $2,000 | $5,000 |

| AL | Baldwin | 1003 | 1 | AL-003-1 | 49.5 | 27 | 182,265 | No | 200 | $20,000 | $50,000 |

| AL | Baldwin | 1003 | 2 | AL-003-2 | 50.5 | 27 | 182,265 | No | 200 | $20,000 | $50,000 |

| AL | Baldwin | 1003 | 3 | AL-003-3 | 16.5 | 27 | 182,265 | No | 90 | $9,000 | $10,000 |

| AL | Barbour | 1005 | 1 | AL-005-1 | 49.5 | 24 | 27,457 | Yes | 40 | $4,000 | $8,000 |

| AL | Barbour | 1005 | 2 | AL-005-2 | 50.5 | 24 | 27,457 | Yes | 40 | $4,000 | $8,000 |

| AL | Barbour | 1005 | 3 | AL-005-3 | 16.5 | 24 | 27,457 | Yes | 10 | $1,000 | $2,000 |

| AL | Bibb | 1007 | 1 | AL-007-1 | 49.5 | 24 | 22,915 | Yes | 30 | $3,000 | $6,000 |

| AL | Bibb | 1007 | 2 | AL-007-2 | 50.5 | 24 | 22,915 | Yes | 30 | $3,000 | $6,000 |

| AL | Bibb | 1007 | 3 | AL-007-3 | 16.5 | 24 | 22,915 | Yes | 10 | $1,000 | $2,000 |

| AL | Blount | 1009 | 1 | AL-009-1 | 49.5 | 24 | 57,322 | Yes | 80 | $8,000 | $10,000 |

| AL | Blount | 1009 | 2 | AL-009-2 | 50.5 | 24 | 57,322 | Yes | 80 | $8,000 | $10,000 |

| AL | Blount | 1009 | 3 | AL-009-3 | 16.5 | 24 | 57,322 | Yes | 20 | $2,000 | $5,000 |

| AL | Bullock | 1011 | 1 | AL-011-1 | 49.5 | 24 | 10,914 | Yes | 10 | $1,000 | $3,000 |

| AL | Bullock | 1011 | 2 | AL-011-2 | 50.5 | 24 | 10,914 | Yes | 10 | $1,000 | $3,000 |

| AL | Bullock | 1011 | 3 | AL-011-3 | 16.5 | 24 | 10,914 | Yes | 5 | $500 | $1,000 |

| AL | Butler | 1013 | 1 | AL-013-1 | 49.5 | 24 | 20,947 | Yes | 30 | $3,000 | $6,000 |

| AL | Butler | 1013 | 2 | AL-013-2 | 50.5 | 24 | 20,947 | Yes | 30 | $3,000 | $6,000 |

| AL | Butler | 1013 | 3 | AL-013-3 | 16.5 | 24 | 20,947 | Yes | 10 | $1,000 | $2,000 |

| AL | Chambers | 1017 | 2 | AL-017-2 | 50.5 | 8 | 34,215 | Yes | 50 | $5,000 | $10,000 |

| AL | Cherokee | 1019 | 1 | AL-019-1 | 49.5 | 8 | 25,989 | Yes | 30 | $3,000 | $7,000 |

| AL | Cherokee | 1019 | 2 | AL-019-2 | 50.5 | 8 | 25,989 | Yes | 30 | $3,000 | $7,000 |

| AL | Cherokee | 1019 | 3 | AL-019-3 | 16.5 | 8 | 25,989 | Yes | 10 | $1,000 | $2,000 |

| AL | Chilton | 1021 | 1 | AL-021-1 | 49.5 | 24 | 43,643 | Yes | 60 | $6,000 | $10,000 |

| AL | Chilton | 1021 | 2 | AL-021-2 | 50.5 | 24 | 43,643 | Yes | 60 | $6,000 | $10,000 |

| AL | Chilton | 1021 | 3 | AL-021-3 | 16.5 | 24 | 43,643 | Yes | 20 | $2,000 | $4,000 |

| AL | Choctaw | 1023 | 1 | AL-023-1 | 49.5 | 26 | 13,859 | Yes | 20 | $2,000 | $4,000 |

| AL | Choctaw | 1023 | 2 | AL-023-2 | 50.5 | 26 | 13,859 | Yes | 20 | $2,000 | $4,000 |

| AL | Choctaw | 1023 | 3 | AL-023-3 | 16.5 | 26 | 13,859 | Yes | 6 | $600 | $1,000 |

| AL | Clarke | 1025 | 1 | AL-025-1 | 49.5 | 27 | 25,833 | No | 30 | $3,000 | $7,000 |

| AL | Clarke | 1025 | 2 | AL-025-2 | 50.5 | 27 | 25,833 | No | 30 | $3,000 | $7,000 |

| AL | Clarke | 1025 | 3 | AL-025-3 | 16.5 | 27 | 25,833 | No | 10 | $1,000 | $2,000 |

| AL | Clay | 1027 | 1 | AL-027-1 | 49.5 | 8 | 13,932 | Yes | 20 | $2,000 | $4,000 |

| AL | Clay | 1027 | 2 | AL-027-2 | 50.5 | 8 | 13,932 | Yes | 20 | $2,000 | $4,000 |

| AL | Clay | 1027 | 3 | AL-027-3 | 16.5 | 8 | 13,932 | Yes | 6 | $600 | $1,000 |

| AL | Cleburne | 1029 | 2 | AL-029-2 | 50.5 | 8 | 14,972 | Yes | 20 | $2,000 | $4,000 |

| AL | Coffee | 1031 | 1 | AL-031-1 | 49.5 | 24 | 49,948 | Yes | 70 | $7,000 | $10,000 |

| AL | Coffee | 1031 | 2 | AL-031-2 | 50.5 | 24 | 49,948 | Yes | 70 | $7,000 | $10,000 |

| AL | Coffee | 1031 | 3 | AL-031-3 | 16.5 | 24 | 49,948 | Yes | 20 | $2,000 | $4,000 |

| AL | Conecuh | 1035 | 1 | AL-035-1 | 49.5 | 27 | 13,228 | No | 10 | $1,000 | $3,000 |

| AL | Conecuh | 1035 | 2 | AL-035-2 | 50.5 | 27 | 13,228 | No | 10 | $1,000 | $3,000 |

| AL | Conecuh | 1035 | 3 | AL-035-3 | 16.5 | 27 | 13,228 | No | 6 | $600 | $1,000 |

| AL | Coosa | 1037 | 1 | AL-037-1 | 49.5 | 8 | 11,539 | Yes | 10 | $1,000 | $3,000 |

| AL | Coosa | 1037 | 2 | AL-037-2 | 50.5 | 8 | 11,539 | Yes | 10 | $1,000 | $3,000 |

| AL | Coosa | 1037 | 3 | AL-037-3 | 16.5 | 8 | 11,539 | Yes | 5 | $500 | $1,000 |

| AL | Covington | 1039 | 1 | AL-039-1 | 49.5 | 24 | 37,765 | Yes | 50 | $5,000 | $10,000 |

| AL | Covington | 1039 | 2 | AL-039-2 | 50.5 | 24 | 37,765 | Yes | 50 | $5,000 | $10,000 |

| AL | Covington | 1039 | 3 | AL-039-3 | 16.5 | 24 | 37,765 | Yes | 10 | $1,000 | $3,000 |

| AL | Crenshaw | 1041 | 1 | AL-041-1 | 49.5 | 24 | 13,906 | Yes | 20 | $2,000 | $4,000 |

| AL | Crenshaw | 1041 | 2 | AL-041-2 | 50.5 | 24 | 13,906 | Yes | 20 | $2,000 | $4,000 |

| AL | Crenshaw | 1041 | 3 | AL-041-3 | 16.5 | 24 | 13,906 | Yes | 6 | $600 | $1,000 |

| AL | Cullman | 1043 | 1 | AL-043-1 | 49.5 | 24 | 80,406 | Yes | 100 | $10,000 | $20,000 |

| AL | Cullman | 1043 | 2 | AL-043-2 | 50.5 | 24 | 80,406 | Yes | 100 | $10,000 | $20,000 |

| AL | Cullman | 1043 | 3 | AL-043-3 | 16.5 | 24 | 80,406 | Yes | 30 | $3,000 | $7,000 |

| AL | Dale | 1045 | 1 | AL-045-1 | 49.5 | 24 | 50,251 | Yes | 70 | $7,000 | $10,000 |

| AL | Dale | 1045 | 2 | AL-045-2 | 50.5 | 24 | 50,251 | Yes | 70 | $7,000 | $10,000 |

| AL | Dale | 1045 | 3 | AL-045-3 | 16.5 | 24 | 50,251 | Yes | 20 | $2,000 | $4,000 |

| AL | Dallas | 1047 | 1 | AL-047-1 | 49.5 | 24 | 43,820 | Yes | 60 | $6,000 | $10,000 |

| AL | Dallas | 1047 | 2 | AL-047-2 | 50.5 | 24 | 43,820 | Yes | 60 | $6,000 | $10,000 |

| AL | Dallas | 1047 | 3 | AL-047-3 | 16.5 | 24 | 43,820 | Yes | 20 | $2,000 | $4,000 |

Today, the FCC ruled that Dish should not have received small company discounts for their bidding partners in the AWS-3 auction, meaning that Dish would need to pay full price for the spectrum licenses won by Northstar and SNR or they would need to return the spectrum to the FCC for a re-auction.

Below is a map that reflects the AWS-3 spectrum that would be available at auction if Dish declines to pay the full auction price.

The next questions will focus on who could benefit most from this spectrum. In the image below from our Spectrum Ownership Grid, the AWS-3 ownership for the Top 3 US markets are shown. The columns filled with "FCC" indicate the spectrum that would be re-auctioned, so there would be a 5x5 channel in the New York EA (Economic Area Market) and a 10x10 channel in the Chicago market between the Chicago CMA (G channel) and the Chicago EA (H channel). It is work noting that AT&T already has a strong position in these markets, but Verizon lacks AWS-3 spectrum in each of these markets, although no AWS-3 spectrum is available in the Los Angeles market.

In August, we had blog post that discussed the counties that are on the EBS band plan and the way that the EBS license areas were determined. In this post we are going to examine how to use our EBS Whitespace Auction Opportunities Tool.

The EBS Whitespace Auction Opportunities Tool provides carriers, telephone companies, internet service providers (ISP), cable companies, investors, and financial analysts with the tools to evaluate the opportunities in this auction.

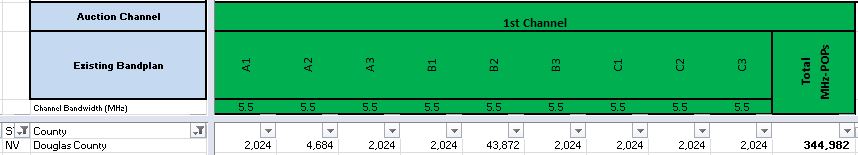

As we discussed before, this auction will provide the winner's access to 3 wide band channels in the EBS (2.5GHz) band. One channels is 49.5 MHz, one channel is 50.5 MHz, and one channel is a combined 17.5 MHz. In the images below, we indicate how each of the existing EBS channels (A1,A2,..) are component channels in the larger wide band EBS Auction channels.

EBS Auction Channel 1:

EBS Auction Channel 2:

EBS Auction Channel 3:

The population that a bidder can serve is determined by the unlicensed population for each of the component channels within each EBS auction channel.

Below is an example of two counties in West Virginia where 100% of the county population is available for each component channel in the EBS Auction Channel 1. In our EBS Whitespace Auction Opportunities Tool this is seen in the Spectrum Grid (% POPs) worksheet. The percentage of the available unlicensed population is divided by the full county population.

Population Percentage Worksheet:

The second worksheet in the EBS Whitespace Auction Opportunities Tool provides the discrete available unlicensed population for each component channel as well as total MHz-POPs for the entire EBS Auction Channel.

Population Worksheet:

Our next example is a Nevada county that has varying available whitespace population for each component channel. In the POPs view immediately below, the available whitespace population for EBS Auction Channel 1 varies from 2,024 for the A1 component channel to 43,872 for the B2 channel.

Population Worksheet:

In the % POPS view, the population comparison to the total county population is highlighted with Red to Green cell colors. For the A1 component channel, the 2,024 available whitespace POPs represents 4% of the Douglas county population while for the B2 component channel, the 43,872 available whitespace POPs represents 93% of the Douglas county population.

Population Percentage Worksheet:

Available Whitespace Area:

In addition to Population Analysis to each component channel, purchasers of the EBS Whitespace Auction Opportunity Tool also receive access to our EBS Whitespace Mapping module in our Web Spectrum Viewer. Selecting either the A1 component channel cell for POPS or for % POPs, the whitespace license area map for that component channel is displayed.

A1 Component Channel Whitespace Area:

For the B2 component channel the whitespace license area fills a majority of Douglas county reflecting the 92% population availability.

B2 Component Channel Whitespace Area:

The EBS Whitespace Auction Opportunities Tools is available either as a nationwide purchase (all 50 states and US territories) or a state by state purchase. The purchase will enable carriers and investors to evaluate their opportunity to add 2.5GHz spectrum in the targeted markets and it will allow investors to quantity the national or state opportunities for these new channels as well as provide an evaluation of the strength or weakness of the existing 2.5GHz licensee in each market.

The primary challenge in evaluating the EBS Whitespace auction opportunities, lies with the available licensing information provided by FCC. For each of the EBS licenses, the FCC provides a map for a 35 mile radius circle from the license centerpoint. Below is the FCC map for WHR463, an EBS A1 channel license in Los Angeles county. Not indicated in this map, is the overlap that this license has with two other A1 channel licenses in Los Angeles county.

WHR463:

In two images below, it is clear that a significant portion WHR463's 35 mile radius license area is shared with WHG227 and WND634.

WHG227:

WND634:

The FCC resolves these overlap issues through the creation of Geographic Service Areas (GSA) for each license_channel combination. The starting point is to look at all of the 35 mile overlaps on an individual channel basis, e.g. A1, A2, ...

Here is an example case with 5 licenses in a 4 county area.

The Geographic Service Areas are initially created by bisecting each of the overlapping areas (splitting the football) so each license has its own exclusive area.

The GSA's were formed based upon active licenses on a specific date. Licenses that were issued after this date (PSA6) do not claim any part of the overlap area with existing GSAs.

These GSA's are sometimes referred to as "Cookie Bite" GSAs.

After the GSA's were formed, any cancelled or terminated licenses lost their area, but none of that area is added to the GSAs that previously overlapped the cancelled/terminated licenses.

The map below represents the licensed spectrum in this 4 county area, prior to the EBS Whitespace Auction for a specific channel.

The final representation of the unlicensed (whitespace) area in each county that will be available in the auction is the area from the GSA boundary for each license to the county boundary.

Going back to Los Angeles County A1 channel example, you can see the WHG227, WHR463, and WND634 licenses in the center of the map reflecting each of their A1 Channel GSAs.

Our final map indicates the whitespace area for the A1 channel in Los Angeles county. Call signs WHG227 and WND634 were both cancelled after the GSA boundaries were computed, thus their license area is now part of the A1 channel EBS Whitespace, indicated in the orange cross hatch.

Source: FCC

Source: FCC

Spektrum Metrics Insights & Analytics is pleased to announce that our Millimeter Wave - Spectrum Ownership Analysis Tool has been updated with the Auction 103 results and is available for purchase.

Below is a sample of the Spectrum Grid Analysis Module, highlighting the 37/39 GHz spectrum ownership for the New York, Los Angeles, and Chicago CMA markets.

The Millimeter Wave - Spectrum Ownership Analysis Tool contains 20 additional analysis modules including:

With our Web Spectrum Viewer subscription, maps for each carrier's total Millimeter Wave spectrum depth and their spectrum depth for each frequency band are available. Below is a map for the 47GHz spectrum that Sprint won in Auction 103.

Click here to contact Spektrum Metrics Insights & Analytics.