Free Shipping On world wide

- HOME

- PRODUCTS

- IN THE NEWS

- SPECTRUM BLOG

- WEB SPECTRUM VIEWER

-

English

-

USD

Free Shipping On world wide

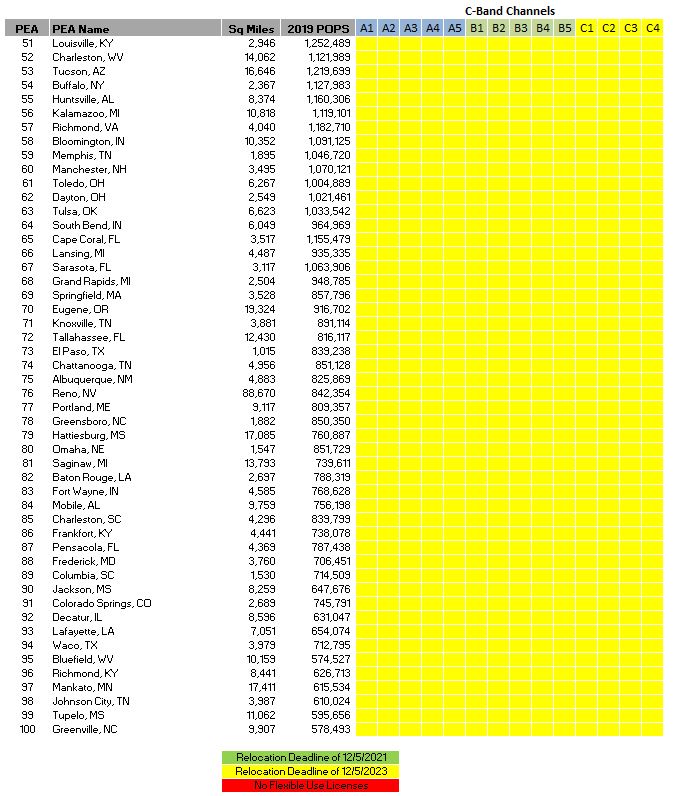

With Auction 107 officially starting a week from tomorrow, we developed a two helpful graphics to indicate when the C-Band channels will be available in each of the Top 100 Partial Economic Area (PEA) markets. The A channels indicated in green will be available by December 5, 2021 with all of the yellow channels available by December 5, 2023. The Honolulu HI PEA will not have C-band spectrum available as the spectrum is reserved to meet the continued satellite video demand.

Today, the FCC ruled that Dish should not have received small company discounts for their bidding partners in the AWS-3 auction, meaning that Dish would need to pay full price for the spectrum licenses won by Northstar and SNR or they would need to return the spectrum to the FCC for a re-auction.

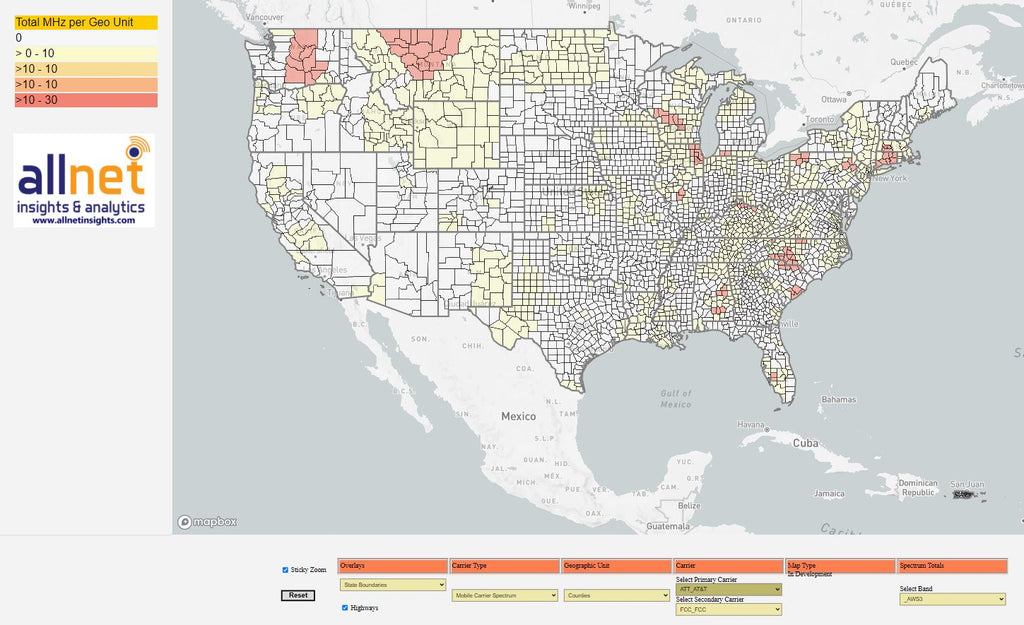

Below is a map that reflects the AWS-3 spectrum that would be available at auction if Dish declines to pay the full auction price.

The next questions will focus on who could benefit most from this spectrum. In the image below from our Spectrum Ownership Grid, the AWS-3 ownership for the Top 3 US markets are shown. The columns filled with "FCC" indicate the spectrum that would be re-auctioned, so there would be a 5x5 channel in the New York EA (Economic Area Market) and a 10x10 channel in the Chicago market between the Chicago CMA (G channel) and the Chicago EA (H channel). It is work noting that AT&T already has a strong position in these markets, but Verizon lacks AWS-3 spectrum in each of these markets, although no AWS-3 spectrum is available in the Los Angeles market.

On October 23, 2020 the FCC granted EBS whitespace licenses to 154 Tribal Applicants through the Tribal Priority Window. This is the first stage to the EBS (2.5 GHz) auction. Below is a map representing all 154 tribal areas (in brown) along with the licensing contours (in green) for the EBS A1 channel. Most of the 154 tribal applications claimed the unlicensed (whitespace) area for each of the three EBS auction channels.

It is important to recall that each of the EBS auction channels consists of multiple existing EBS channels that have different existing licensing boundaries. EBS Auction Channel 1 consists of the A1 channel shown in the map along with 8 other EBS channels. In the map below, we show how the Tribal whitespace boundaries overlap with the existing license boundaries in Southern Utah and Northern Arizona. For the areas that are covered by the green licensed areas, the Tribal applicants do not have access to the A1 channel in EBS Auction Channel 1.

To determine the amount of spectrum available to each Tribal area, you must evaluate the available whitespace area with the Tribal boundary for each existing license channel like we did above for the EBS A1 channel.

In the November 2020 updates to our Mobile Carrier and Millimeter Wave - Spectrum Ownership Analysis Tools, we have added Carrier - Spectrum Ownership Charts that provide a breakdown of each carriers spectrum assets by band classification (low band, lower mid band, and upper mid band) and by frequency band. Each of these charts are based upon the total MHz-POPs that a carrier controls in each band classification or frequency band. Within the each Spectrum Ownership Analysis Tool, eight carriers can be selected from the available 2200 licensees and spectrum holders, to compare each carriers spectrum portfolio side by side.

Carrier Spectrum Divisions (by Band Classification):

Carrier Spectrum Divisions (by Frequency Band):

In both tools we continue to also have charts that detail for the same eight selectable carriers, each carrier's proportional ownership for each frequency band.

National Band Ownership:

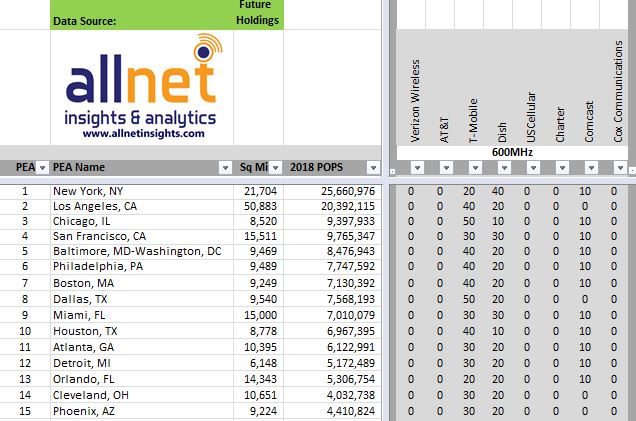

Last month we presented some initial analysis of T-Mobile's agreement to lease 200 - 600MHz licenses from Dish. Now that we have released our October 2020 Mobile Carrier - Spectrum Ownership Analysis Tool reflecting all of the September 2020 transactions, we can compare the 600MHz results between the October 2020 and September 2020 versions.

MHz-POPs:

Our October 2020 - Spectrum Ownership Analysis Tool reports that T-Mobile controls 12,593,033,060 MHzPOPs in the 600MHz band, an increase of 982,154,940 MHzPOPs over the number of MHzPOPs that T-Mobile held in September.

Spectrum Grid:

In the Spectrum Grid sequence below, You can see the effect of two transactions that were both filed in September. First, Charter's lease of Comcast's A block spectrum is seen in the top image (October 2020) and T-Mobile's lease of Dish's D block spectrum can be seen to increase their New York channel size to 15MHz. The lower image represents each carrier's spectrum held for September 2020.

October 2020:

September 2020:

PEA Market Analysis:

In comparing the PEA Market Analysis outputs below, you can see the increase in T-Mobile's 600MHz spectrum in New York, Miami, Detroit, Orlando, and Cleveland.

October 2020:

September 2020:

In August, we had blog post that discussed the counties that are on the EBS band plan and the way that the EBS license areas were determined. In this post we are going to examine how to use our EBS Whitespace Auction Opportunities Tool.

The EBS Whitespace Auction Opportunities Tool provides carriers, telephone companies, internet service providers (ISP), cable companies, investors, and financial analysts with the tools to evaluate the opportunities in this auction.

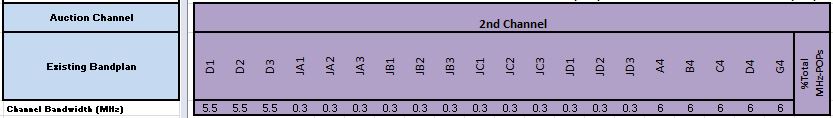

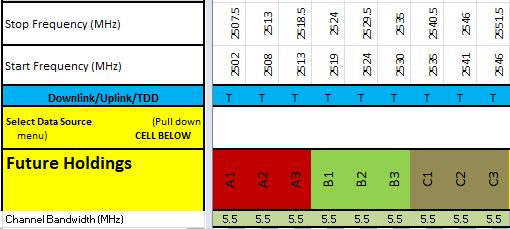

As we discussed before, this auction will provide the winner's access to 3 wide band channels in the EBS (2.5GHz) band. One channels is 49.5 MHz, one channel is 50.5 MHz, and one channel is a combined 17.5 MHz. In the images below, we indicate how each of the existing EBS channels (A1,A2,..) are component channels in the larger wide band EBS Auction channels.

EBS Auction Channel 1:

EBS Auction Channel 2:

EBS Auction Channel 3:

The population that a bidder can serve is determined by the unlicensed population for each of the component channels within each EBS auction channel.

Below is an example of two counties in West Virginia where 100% of the county population is available for each component channel in the EBS Auction Channel 1. In our EBS Whitespace Auction Opportunities Tool this is seen in the Spectrum Grid (% POPs) worksheet. The percentage of the available unlicensed population is divided by the full county population.

Population Percentage Worksheet:

The second worksheet in the EBS Whitespace Auction Opportunities Tool provides the discrete available unlicensed population for each component channel as well as total MHz-POPs for the entire EBS Auction Channel.

Population Worksheet:

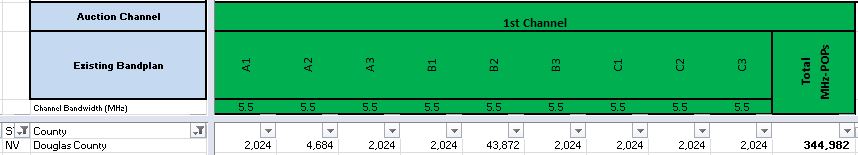

Our next example is a Nevada county that has varying available whitespace population for each component channel. In the POPs view immediately below, the available whitespace population for EBS Auction Channel 1 varies from 2,024 for the A1 component channel to 43,872 for the B2 channel.

Population Worksheet:

In the % POPS view, the population comparison to the total county population is highlighted with Red to Green cell colors. For the A1 component channel, the 2,024 available whitespace POPs represents 4% of the Douglas county population while for the B2 component channel, the 43,872 available whitespace POPs represents 93% of the Douglas county population.

Population Percentage Worksheet:

Available Whitespace Area:

In addition to Population Analysis to each component channel, purchasers of the EBS Whitespace Auction Opportunity Tool also receive access to our EBS Whitespace Mapping module in our Web Spectrum Viewer. Selecting either the A1 component channel cell for POPS or for % POPs, the whitespace license area map for that component channel is displayed.

A1 Component Channel Whitespace Area:

For the B2 component channel the whitespace license area fills a majority of Douglas county reflecting the 92% population availability.

B2 Component Channel Whitespace Area:

The EBS Whitespace Auction Opportunities Tools is available either as a nationwide purchase (all 50 states and US territories) or a state by state purchase. The purchase will enable carriers and investors to evaluate their opportunity to add 2.5GHz spectrum in the targeted markets and it will allow investors to quantity the national or state opportunities for these new channels as well as provide an evaluation of the strength or weakness of the existing 2.5GHz licensee in each market.

The 10 highest bidders in the CBRS auction are shown in the table below. How did each of these bidders' investments translate into the percent of the their ownership within the CBRS band?

In our Frequency Band Ownership chart from our updated Mobile Carrier - Spectrum Ownership Analysis Tool, you can see the relative ownership percentages based upon each bidders total MHz-POPs in the CBRS band. Clearly the top 5 bidders turned their investment into a significant share of the CBRS band.

The primary challenge in evaluating the EBS Whitespace auction opportunities, lies with the available licensing information provided by FCC. For each of the EBS licenses, the FCC provides a map for a 35 mile radius circle from the license centerpoint. Below is the FCC map for WHR463, an EBS A1 channel license in Los Angeles county. Not indicated in this map, is the overlap that this license has with two other A1 channel licenses in Los Angeles county.

WHR463:

In two images below, it is clear that a significant portion WHR463's 35 mile radius license area is shared with WHG227 and WND634.

WHG227:

WND634:

The FCC resolves these overlap issues through the creation of Geographic Service Areas (GSA) for each license_channel combination. The starting point is to look at all of the 35 mile overlaps on an individual channel basis, e.g. A1, A2, ...

Here is an example case with 5 licenses in a 4 county area.

The Geographic Service Areas are initially created by bisecting each of the overlapping areas (splitting the football) so each license has its own exclusive area.

The GSA's were formed based upon active licenses on a specific date. Licenses that were issued after this date (PSA6) do not claim any part of the overlap area with existing GSAs.

These GSA's are sometimes referred to as "Cookie Bite" GSAs.

After the GSA's were formed, any cancelled or terminated licenses lost their area, but none of that area is added to the GSAs that previously overlapped the cancelled/terminated licenses.

The map below represents the licensed spectrum in this 4 county area, prior to the EBS Whitespace Auction for a specific channel.

The final representation of the unlicensed (whitespace) area in each county that will be available in the auction is the area from the GSA boundary for each license to the county boundary.

Going back to Los Angeles County A1 channel example, you can see the WHG227, WHR463, and WND634 licenses in the center of the map reflecting each of their A1 Channel GSAs.

Our final map indicates the whitespace area for the A1 channel in Los Angeles county. Call signs WHG227 and WND634 were both cancelled after the GSA boundaries were computed, thus their license area is now part of the A1 channel EBS Whitespace, indicated in the orange cross hatch.

Source: FCC

Source: FCC

Recently the FCC has revised the Sub-6 GHz spectrum screen through the following rulemakings; the CBRS report and order, the 2.5GHz spectrum transformation report and order, and the C-band report and order.* In the chart below we reflect the spectrum allotments that are included in our Mobile Carrier - Spectrum Ownership Analysis Tool compared to the allotments that apply to the FCC Spectrum Screen.

The FCC divides the Spectrum Screen Total by 3 and rounds to 10 MHz. So the Spectrum Screen seems to be set at 340 MHz for Sub-6 GHz spectrum.

Beginning with our July 2020 release of the Mobile Carrier - Spectrum Ownership Analysis Tool, we have updated our Spectrum Screen calculations to include the additional EBS and C-band spectrum.

The Spectrum Screen calculations are available in the County Analysis Module, the CMA Market Analysis Module, and the PEA Market Analysis Module.

In the County Analysis Module, the Spectrum Screen values are displayed for each of 8 selected carriers for each US county. Nearly 2,000 carriers and spectrum owners can be selected for analysis. Auto filters can be set on the 340 MHz spectrum screen value, or set lower to forecast the head room a carrier would need to acquire 100 MHz of spectrum in the C-band auction without exceeding the spectrum screen.

The analysis carries over to the PEA Market Analysis Module and the CMA Market Analysis Module where auto filters again can be set to model specific conditions to determine carriers likely thresholds by market.

* Appreciation to Fred Campbell with Wireless 20|20 for his assistance in compiling the recent rulemakings Spectrum Screen effects.

Why don't we see charts that show both Sub 6GHz and Millimeter Wave Spectrum? I created the chart below to illustrate each carriers low band, mid band, and millimeter wave (high band) spectrum ownership. This is not a view that I favor because the spectrum that is the most important today and likely for at least the next 5 years in buried at the bottom of the chart. The values in the chart represent the population weighted average of each carrier's spectrum. The important features of spectrum for the next 5 years will center on upper mid-band spectrum where 5G networks can have significant speed/capacity along with reasonable coverage. Upper mid-band spectrum will be the only spectrum where large channel sizes (greater than 20MHz) will be available, but it is clearly difficult to evaluate each carriers available spectrum when the bar graphs are dominated by millimeter wave spectrum.

Last week we saw the first applications filed at the FCC that transfer educational (2.5GHz) spectrum to commercial carriers. These are the first applications received by the FCC that take advantage of the new rules that were released in the Transforming the 2.5GHz Band Report & Order. Below are the details for the Educational Spectrum transfers from our Spectrum Transaction Summary that was released last Friday. Prior to this Report & Order, commercial carriers could only utilize the educational spectrum via a spectrum lease.

Purpose

Assignee

Assignor

CallSign

Map

RadioService

Market

Channel

Assignment

Adams Telcom

Brown County Community Unit School #1

WLX713

Map

EBS

P03398 - P35 GSA,40-6-37.2 N,91-1-47.5 W

G

Assignment

Adams Telcom

Community Unit School District #3

WLX717

Map

EBS

P01103 - P35 GSA,40-6-37.2 N,91-1-47.5 W

D

Assignment

Adams Telcom

Community Unit School District #4

WLX643

Map

EBS

P02520 - P35 GSA,40-6-37.2 N,91-1-47.5 W

C

Assignment

Adams Telcom

COMMUNITY UNIT SCHOOL DISTRICT #337

WLX644

Map

EBS

P01089 - P35 GSA,40-6-37.2 N,91-1-47.5 W

B

Assignment

Adams Telcom

COMMUNITY UNIT SCHOOL DISTRICT #337

WLX646

Map

EBS

P02060 - P35 GSA,40-6-37.2 N,91-1-47.5 W

A

Assignment

T-Mobile

Midstate College

WLX887

Map

EBS

P01124 - P35 GSA,40-37-44.1 N,89-34-12.4 W

B

Assignment

SoniqWave Networks

BeamSpeed

WMX652

Map

EBS

P02044 - P35 GSA,32-40-24.2 N,114-20-15.8 W

C

Assignment

SoniqWave Networks

BeamSpeed

WMX653

Map

EBS

P03745 - P35 GSA,32-40-24.2 N,114-20-15.8 W

D

Assignment

SoniqWave Networks

Happy House Day Care

WND521

Map

EBS

P03045 - P35 GSA,30-14-40.8 N,82-40-10.4 W

B

Assignment

SoniqWave Networks

Luzerne County Community College

WNC566

Map

EBS

P03161 - P35 GSA,41-10-58.3 N,75-52-19.7 W

G

In April, El Economista highlighted a transfer of 3.5GHz spectrum in Mexico from Telmex to Telcel. The article highlights a series of consultations between Telmex, Telcel, AT&T, and the Federal Telecommunications Institute (IFT). I will use our Mobile Carrier - Spectrum Ownership Analysis Tool (MEX) to examine these transactions and the overall 5G spectrum plans in Mexico.

Our Spectrum Grid from December 2019, reflects the ownership of the 3.5GHz band prior to the Telcel acquisition. At this point, Telmex, AT&T, and Axtel each owned 50MHz of spectrum (25MHz of uplink and 25MHz of downlink spectrum). In this view we included a TDD band class 48 which is the only band class defined by 3GPP for this band. Obviously, systems using this band configuration are not using band class 48 since they are FDD and band class 48 is TDD.

AT&T and Telmex approached the Federal Telecommunications Institute (IFT) in December to request that they exchange AT&T's D channel for Telmex's H channel, providing each carrier with 50MHz blocks of spectrum in the 3.5GHz band. This exchange only makes sense if IFT reconfigured the entire band to TDD spectrum.

The new configuration is reflected in the image below with Telcel acquiring Telmex's 50MHz channel. Now Telcel and AT&T are set up with the minimum 5G channel size in one of Mexico's two TDD bands and IFT also has 150MHz of spectrum remaining for a future auction. It is interesting to note, that both Canada and Mexico have opted for licensing spectrum directly to carriers for their 3.5GHz bands while the USA has gone with the shared spectrum and PAL licensing approach.

Last week, Lightreading published an article about TeraGo's Fixed Wireless aspirations utilizing 24GHz and 38GHz. We have just updated our Millimeter Wave - Spectrum Ownership Analysis Tool (CAN) to reflect the recent (ISED) consultation outlining Canada's millimeter wave spectrum configuration and upcoming auction. This is important because TeraGo's plans rely on the existing paired spectrum configuration of the 38GHz band plan. This band plan was compatible with the US 39GHz plan prior to Auction 103 when the plan was changed to TDD channels.

Canada is changing the configuration of the above 38GHz band from fixed use to flexible use along with adding the spectrum down to 37.6GHz and up to 40GHz. This creates a 37/39GHz band that is compatible with the US spectrum plans.

Now that ISED has chosen to reconfigure the 38GHz they needed to either cancel the existing licenses from the 38GHz Fixed Service or create a transition plan. ISED opted for the transition plan. The existing 38GHz licenses will transition to an equal amount of spectrum in the 37/39GHz band at the end of their existing 10 year license term. Looking at several of TeraGo's licenses, it appears that transition will occur in 2025.

Last week we began to see announcements from the FCC authorizing a series of temporary spectrum usage agreements to provide additional spectrum to several of the wireless operators to increase network capacity as workers are dispatched to their homes.

We will look at the effect of these agreements in a few markets to see how they are increasing LTE capacity. The analysis will be supported with outputs from our Mobile Carrier - Spectrum Ownership Analysis Tool specifically the Spectrum Ownership Grid.

T-Mobile 600MHz Capacity Expansion:

The first agreement provides T-Mobile with access to 600MHz spectrum from Bluewater Wireless, Channel 51 LIcense Co and LB License Co (Columbia Capital), CC Wireless Investment (Comcast), ParketB.com Wireless (Dish), New Level (Grain), and Tstar License Holdings (Tri-Star).

In the image below for the New York CMA market, T-Mobile will have access to Comcast's spectrum (XFI) and Dish's spectrum increasing their 600MHz channel size in New York from 10MHz channel to a 20MHz channel. T-Mobile would have access to the entire 35MHz of spectrum so they could provide a 20MHz channel and a 10MHz channel for capacity. Because T-Mobile has already deployed Band 71 equipment in New York, they can turn up the expanded spectrum without additional equipment installations.

USCellular AWS-3 Capacity Expansion:

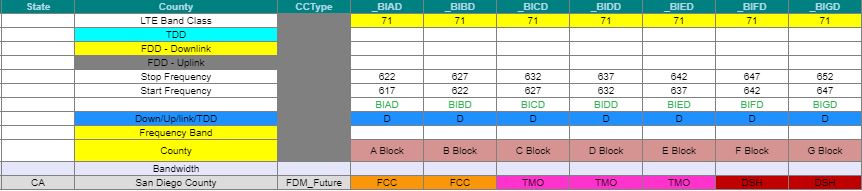

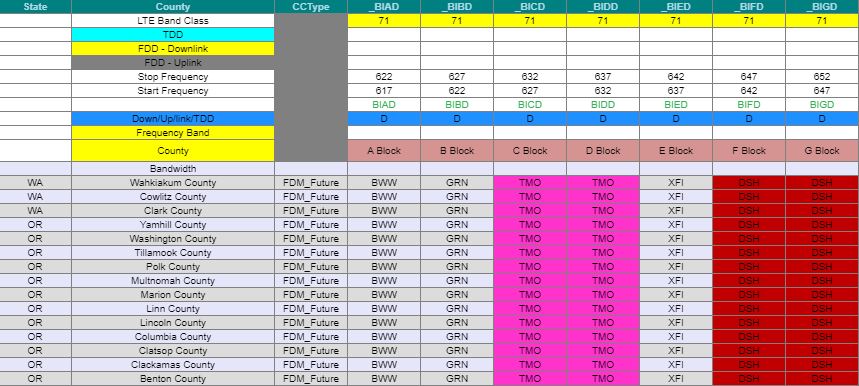

The next agreement provides USCellular access to AWS-3 spectrum from their bidding partner Advantage Spectrum. In the image below a few of the Washington markets where USCellular will access AWS-3 spectrum are indicated. In most of these markets, USCellular currently operates on their cellular frequencies but doesn't have Band 66 operations.Thus, USCellular will need to add base stations and antennas to their sites for Band 66 to utilize these new frequencies. In five of these counties USCellular is likely operating on AWS-1 spectrum in Band 66 so the spectrum will be easier to deploy in those counties.

Verizon AWS-3 Capacity Expansion:

In the image below we illustrate the AWS-3 spectrum that Verizon will gain temporary access from SNR License Co and Northstar Wireless (both Dish partners). Northstar controls the AWS-3 G channel and SNR LIcense Co controls the AWS-3 H channel. In the New York market, Northstar Wireless owns the G block spectrum and SNR Wireless owns the H block spectrum. Accessing this spectrum will provide Verizon a second Band 66 LTE channel, increasing their LTE capacity from 20MHz to 30MHz.

Verizon & AT&T AWS-3 Capacity Expansion:

Verizon and AT&T have also requested access to the spectrum that Northstar Wireless and SNR Wireless returned to the FCC when their auction discounts were eliminated. The AWS-3 spectrum depth that is "unassigned" is indicated in the map below. In our data, we reflect these unassigned licenses with the FCC heading.

AT&T requested the I block spectrum in the New York market, so it will expand their Band 66 LTE from 10MHz to 15MHz. The markets AT&T requested are listed here and the markets that Verizon requested are here.

AT&T AWS-4 Capacity Expansion:

AT&T has also requested access to Dish's Band 66 spectrum. From the image above AT&T can expand their Band 66 LTE by and additional 5MHz to 20MHz by using part of Dish's AWS-4 spectrum. AT&T will still have an additional 15MHz of Dish's spectrum that they could use as an additional LTE channel in New York. AT&T only requested access to Dish's Band 66 spectrum, not their Band 70 AWS-4 spectrum.

AT&T 700MHz E-block Expansion:

Dish also reported that AT&T requested access the the 700MHz E-block in the markets that AT&T doesn't own. In the image below, Dish's ownership in Chicago and Detroit will provide AT&T the capability to expand their Band 29 supplemental downlink from 5MHz to 10MHz.

Earlier this month, Verizon filed to acquire all of Orion Wireless' paired AWS-3 spectrum. This is Verizon's third acquisition of AWS-3 spectrum in the last six months. Last year Verizon filed to acquire AWS-3 spectrum from Cypress Cellular and Blue Ridge Wireless.

Geographic Coverage:

The map below depicts all of Orion Wireless' AWS-3 licenses. 15 of Orion Wireless' licenses are for the AWS-3 G block and one for the AWS-3 I block. This acquisition provides Verizon an additional 10 MHz of spectrum (5x5) in the in the areas where only Orion only controlled one license and 20 MHz of spectrum in two Minnesota counties where they control both the G and I blocks.

It is also interesting to look at how this spectrum will fit with Verizon's existing Band 66 spectrum. Below is an output from our Spectrum Grid where you can see all of Orion Wireless' spectrum (OWL). In most counties, the spectrum is not contiguous with Verizon's existing spectrum assignments, but in 5 Iowa counties, the Orion Wireless spectrum will provide Verizon with a larger second LTE channel ranging from 10 to 15 MHz.

Spektrum Metrics Insights & Analytics is pleased to announce that our Millimeter Wave - Spectrum Ownership Analysis Tool has been updated with the Auction 103 results and is available for purchase.

Below is a sample of the Spectrum Grid Analysis Module, highlighting the 37/39 GHz spectrum ownership for the New York, Los Angeles, and Chicago CMA markets.

The Millimeter Wave - Spectrum Ownership Analysis Tool contains 20 additional analysis modules including:

With our Web Spectrum Viewer subscription, maps for each carrier's total Millimeter Wave spectrum depth and their spectrum depth for each frequency band are available. Below is a map for the 47GHz spectrum that Sprint won in Auction 103.

Click here to contact Spektrum Metrics Insights & Analytics.

With the release of our March 2020 Mobile Carrier and Millimeter Wave - Spectrum Ownership Analysis Tools we have included a new analysis module which details the frequency band ownership for eight user selected carriers. With the results for Auction 103 expected later this week, we are including the charts for the Millimeter Wave frequency bands. These charts detail each carrier's total ownership in a band, measured in terms of MHz-POPs.

Looking at the 28GHz chart, you can see that Verizon owns 73% of the band while T-Mobile controls 14%. The 37GHz, 39GHz, and 47GHz slides reflect the FCC controlling 100% of each spectrum band. In the second chart, reflecting our February 2020 data, the spectrum held in the 39GHz band, pre-auction is indicated. Verizon controlled 39% of this band prior to the auction and AT&T controlled 27%. All of this spectrum was traded back into the FCC before Auction 103 started, so it will be interesting to see how all of the carrier's bidding activity affect these charts, once the auction results are posted.

We anticipate releasing a mid-month release of our Millimeter Wave - Spectrum Ownership Analysis Tool within two days of the FCC results announcement.

Millimeter Wave Frequency Band Ownership (March 2020):

Millimeter Wave Frequency Band Ownership (February 2020):